Development of HoReCa Markets Across Europe as a Compass For Sales Opportunities

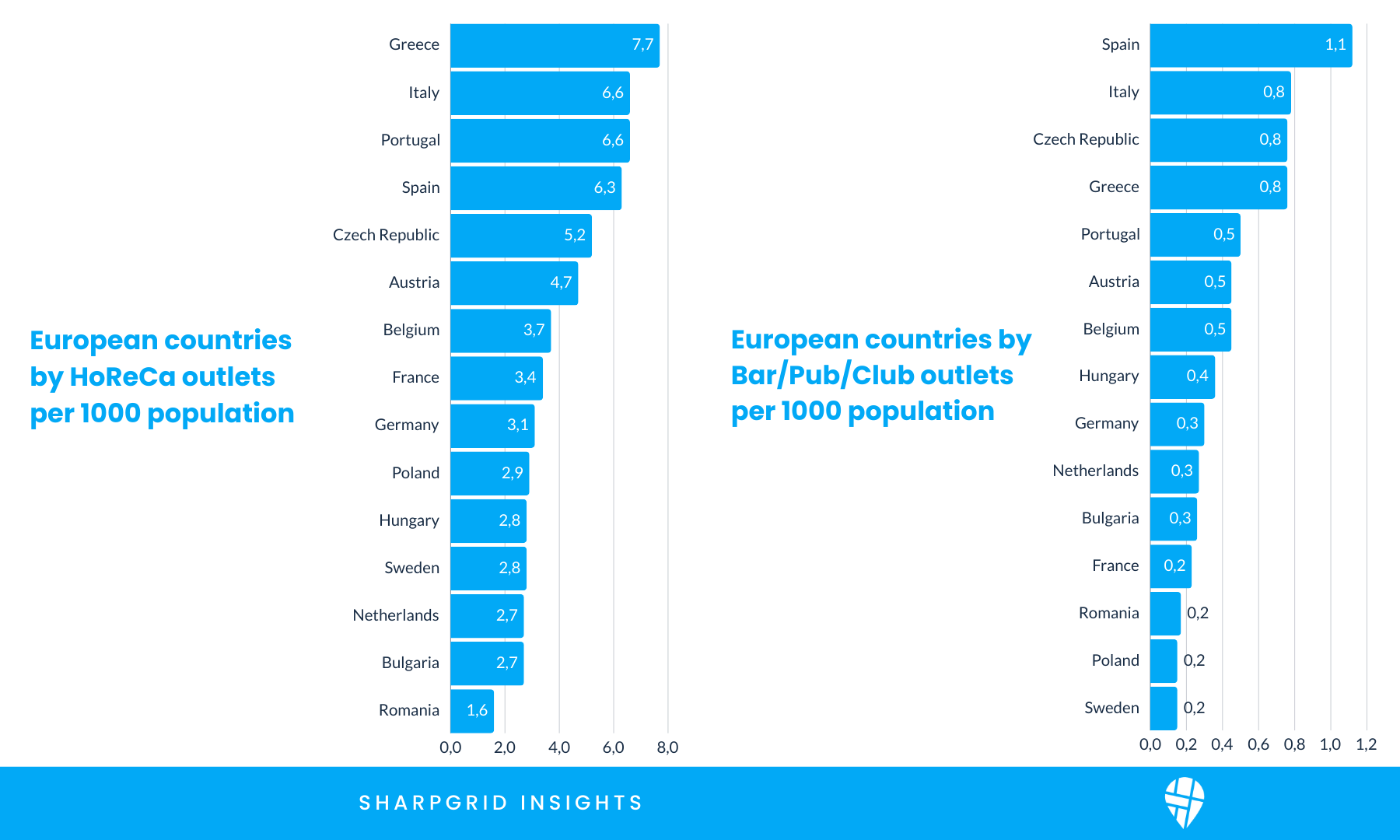

The development level of a HoReCa market isn’t just about size; it’s a combination of outlets per capita, the density of bars, pubs, and clubs (Core Beverage Outlets for the purpose of this article), the country’s population size, tourism and consumer’s purchasing power.

By analyzing these factors, we can uncover which markets lead the way and which hold hidden potential for growth. Here we focus mainly on the outlet count and density compared to market population. Let’s explore the most-developed and least-developed HoReCa markets in Europe, supported by granular data, including popular drink trends.

Access free demo with live data (available in European 38 countries)

First, let’s have a look at a table showing the outlet-per-capita structure of top EU countries by outlet count.

As we can see, some countries’ HoReCa markets are clearly more developed than others.

Top-Tier HoReCa Markets: High Density, High Potential

The top five countries—Greece, Italy, Portugal, Spain, and Czech Republic—are leading examples of highly developed HoReCa markets. They feature high outlet densities and vibrant Core Beverage Outlet segment reflecting not only the market development but also a significant tourism factor, making them lucrative for HoReCa suppliers.

Greece

- 7.66 HoReCa outlets per 1,000 people - the highest density in Europe.

- 9.89% of outlets are Core Beverage Outlets (7,877 in total).

- Greece’s combination of outlet density and Core Beverage Outlets share reflects a strong drinking culture, ideal for introducing new beverages.

Italy

- 6.64 outlets per 1,000 people - A massive 398,491 count.

- 46,835 Core Beverage Outlets (11.75% of outlets), offering unparalleled scale for beverage producers targeting social venues.

- The size of the Italian market allows for regional strategies, from craft beer in the north to wine-inspired cocktails in the south.

Portugal

- 6.56 outlets per 1,000 people, close to Italy’s density.

- Core Beverage Outlets count of 5,160, representing 7.63% of outlets. While smaller than others, this segment shows room for growth in nightlife and premium offerings.

Spain

- 6.32 outlets per 1,000 people and 52,723 bars - the highest absolute number of Core Beverage Outlets in Europe.

- Bars make up 17.76% of outlets, highlighting the central role of nightlife in Spain’s beverage market.

Czech Republic

- 5.19 outlets per 1,000 people and 8,107 bars (14.58% of outlets).

- Its Core Beverage Outlet density (0.76 per 1,000 people) matches Greece’s, showcasing a strong cultural inclination toward social drinking venues.

Insights from Top Markets:

- Density Drives Demand: High HoReCa outlet density correlates with stronger consumer engagement in beverages, especially in social settings.

- Bars Are Critical: The percentage of Core Beverage Outlets among total outlets is a key indicator of how much of the market is focused on beverages rather than food.

- Opportunities for Innovation: Markets like Poland and Sweden, with lower Core Beverage Outlets shares, may benefit from introducing modern bar concepts, such as craft cocktail lounges or specialty beer pubs.

Lower-Tier Markets: Undeveloped Yet Promising

At the other end of the spectrum, countries like Hungary, Sweden, Netherlands, Bulgaria, and Romania show lower HoReCa density but sometimes hold potential in their Core Beverage Outlets segments.

Hungary:

- 2.8 outlets per 1,000 people—among the lowest densities in Europe.

- Core Beverage Outlets make up 12.74% of outlets, a high share that signals opportunities for growth in social venues, especially in party/tourist cities like Budapest.

Sweden:

- 2.8 outlets per 1,000 people, the lowest in Europe.

- Core Beverage Outlets account for just 5.27% of outlets (second-lowest after Poland), reflecting a more restrained and regulated drinking culture. Beverage producers could explore niche opportunities, such as premium or craft offerings.

Netherlands:

- 2.7 outlets per 1,000 people, with 10% of outlets being Core Beverage Outlets.

- Despite lower density, the medium-high Core Beverage Outlet share suggests a focus on social drinking venues, particularly in urban centers.

Bulgaria:

- 2.7 outlets per 1,000 people, with Core Beverage Outlets comprising 9.73% of outlets.

- Its 1,794 Core Beverage Outlets present opportunities for affordable beverage options, catering to a cost-conscious consumer base.

Romania:

- 1.6 outlets per 1,000 people, one of the lowest densities.

- However, its 3,175 Core Beverage Outlets(10.35% of outlets) show a strong emphasis on social venues, indicating a cultural preference for drinking spaces despite lower overall development.

Insights from Emerging Markets

- Markets With High % of Core Beverage Outlets Have Potential: Despite low overall development, countries like Hungary and Netherlands have relatively high bar shares, making them attractive for targeted beverage campaigns.

- Urban Focus Is Key: Beverage producers can focus on urban centers in these countries, where nightlife venues are concentrated.

- Niche Strategies Work: Craft, premium, or culturally specific drinks (e.g., wine in Romania or beer in Netherlands) may resonate more with these markets.

Opportunities for Beverage Producers

Invest in Core Beverage Outlets in Undeveloped Markets: Countries like Romania and Hungary could benefit from modernizing their bar scenes, with concepts like craft beer pubs or premium lounges.

Scale Innovation in Top Markets: Spain and Italy are perfect for large-scale beverage campaigns, leveraging their massive bar networks and drinking cultures.

Focus on Urban Niches: In lower-density markets like Sweden, targeting urban nightlife venues with premium beverages could drive growth.

Core Beverage Outlets Marketing: The Netherlands’ 10% Core Beverage Outlets share shows strong potential for beverage-specific promotions aimed at social venues.

Conclusion

Europe’s HoReCa markets are as diverse as its cultures. From the highly developed markets of Spain, Italy, and Greece, to the promising Core Beverage Outlet-focused opportunities in Hungary and Netherlands, Sharpgrid’s data reveals that beverage producers can find success by tailoring strategies to market dynamics.

Whether scaling campaigns in high-density markets or seizing niche opportunities in emerging ones, the HoReCa sector offers abundant potential for growth. Sharpgrid’s granular insights are the key to unlocking it.

Ready to transform your beverage strategy? Contact Sharpgrid today for actionable market intelligence.